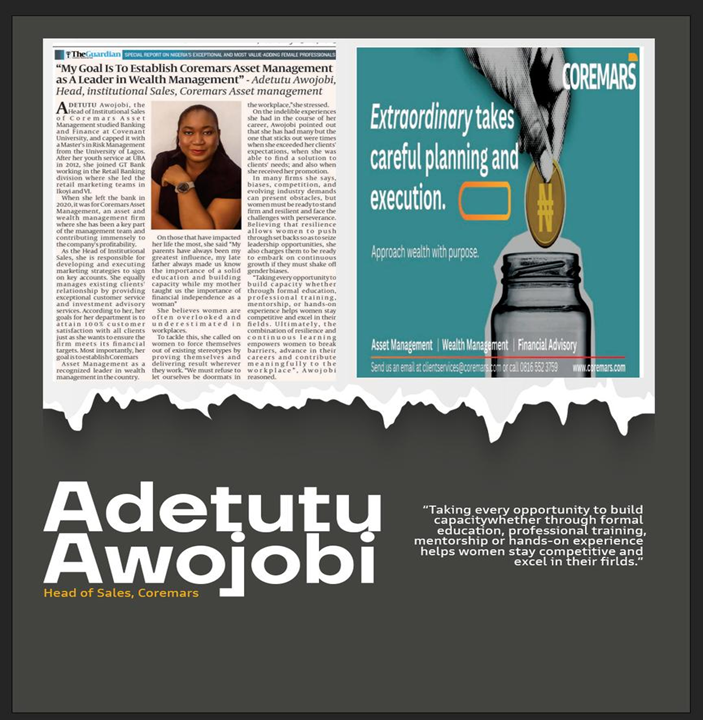

My Goal Is To Establish Coremars Asset Management as A Leader in Wealth Management” – Adetutu Awojobi, Head, institutional Sales, Coremars Asset management

ADETUTU Awojobi, the Head of Institutional Sales at Coremars Asset Management studied Banking and Finance at Covenant University, and capped it with a Master’s in Risk Management from the University of Lagos. After her youth service at UBA in 2012, she joined GTBank working in the Retail Banking division where she led the retail marketing teams in Ikoyi and Victoria Island.

When she left the bank in 2020, it was for Coremars Asset management, an asset and wealth management firm where she has been a key part of the management team and contributing immensely to the company’s profitability.

As the Head of Institutional Sales, she is responsible for developing and executing marketing strategies to sign on key accounts. She equally manages existing client relationships by providing exceptional customer services and investment advisory services. According to her, her goals for her department is to attain 100% customer satisfaction with all clients just as she wants to ensure the firm meets its financial targets. Most importantly, her goal is to establish Coremars Asset Management as a recognized leader inn wealth management in the country.

On those that have impacted her life the most, she said “My parents have always been my greatest influence, my late father always made us know the importance of a solid education and building capacity while my mother taught us the importance of financial independence as a woman”.

She believes women are often overlooked and underestimated in workplaces. To tackles this, she called on women to force themselves out of the existing stereotypes by providing themselves and delivering result wherever they work. “We must refuse to let ourselves be doormats in the workplace”, she stressed.

On the indelible experiences she had in the course of her career, Awojobi pointed out that she has had many but the one that sticks our were times when she exceeded her clients expectation, when she was able to find solution to her clients needs; and also when she received her promotion. In many firms she says, biases, competition, and evolving industry demands can present obstacles, but woman must be ready to stand firm and resilient and face the challenges with perseverance. Believing that resilience allows women to push through set backs so as t o seize leadership opportunities, she also changes then to be ready to embark on continuous growth if they must shake off gender biases.

“Taking every opportunity to build capacity whether through formal education, professional training, mentorship, or hands-on experience helps woman stay competitive and excel in their fields. Ultimately, the combination of resilience and continuous learning empowers women to break barriers, advance in their careers and contribute meaningfully to the workplace”. Awojobi reasoned.